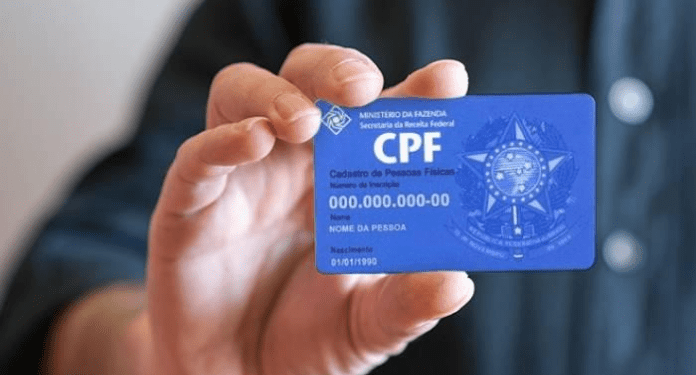

The Cadastro de Pessoas Físicas (CPF) is an essential document for Brazilians, as it is necessary for banking transactions, employment, and tax payments, among others. For foreigners who wish to invest, open a business, or engage in professional activities in Brazil, obtaining a CPF is also necessary.

The CPF is a unique tax identification number assigned to every Brazilian citizen or foreigner residing in Brazil. For foreigners, it is possible to obtain it by personally visiting a Receita Federal agency (Brazilian tax administration) or through a legal representative in Brazil, such as a lawyer or specialized company, as well as online through the Receita Federal website.

Obtaining a CPF is an important step for those looking to invest or do

business in this dynamic and growing country.

To obtain a CPF, foreigners must provide a series of documents, such as their passport, CIN, etc… It is important to check with Receita Federal for the specific documents required for your particular situation.

Once obtained, the CPF allows foreigners to engage in professional activities in Brazil, such as opening a business, investing in stocks or real estate, and even buying a car. The CPF is also necessary for opening a bank account in Brazil and conducting financial transactions.

It is important to note that the CPF is not a residency authorization in Brazil. Foreigners who wish to reside in Brazil must obtain an appropriate visa from the Brazilian consulate in their country of origin.

In summary, the CPF is an essential document for foreigners wishing to engage in professional or financial activities in Brazil. While it can be a complex process, obtaining a CPF is an important step for those looking to invest or do business in this dynamic and growing country.